JAPAN INCREASED IMPORT OF FRESH, RAW SQUID

03 Sat, 2020

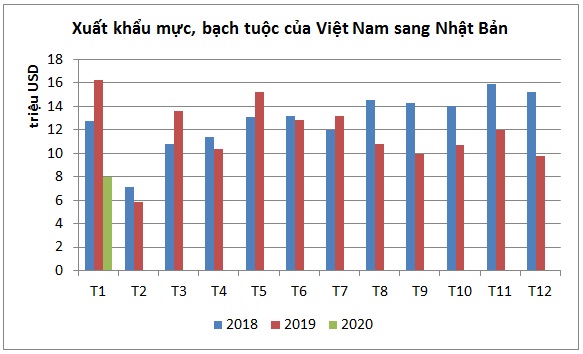

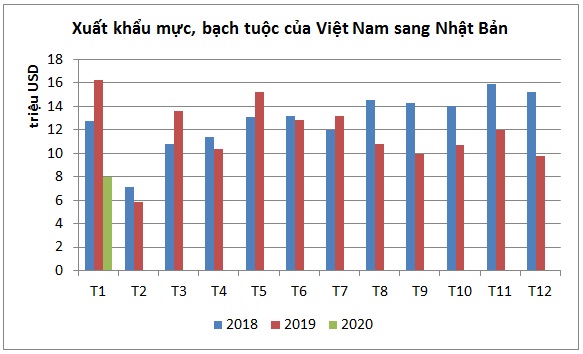

In 2019, Japan imported US $ 140.5 million of squid and octopus from Vietnam in 2019, down 8.9% compared to 2018. Vietnam's octopus and squid exports to Japan decreased continuously from August to the end of the year of 2019. Quarter IV / 2019, squid and octopus exports to Japan reached US $ 32.5 million, down 28% compared to the Quarter IV / 2018.

The proportion of Vietnam's squid and octopus exported to Japan is nearly equivalent. In the structure of squid, octopus of Vietnam exported to Japan, fresh / frozen squid (HS 03) accounted for the highest proportion.

In 2019, Japan sharply decreased imports of dried / baked squid from Vietnam (59.3%) while slightly increasing imports of dried / salted / fresh / frozen octopus from Vietnam (1%).

Vietnam's main squid and octopus products exported to Japan in 2019 include: frozen whole squid, shredded squid, sliced, rings cutted, frozen fillet squid, frozen cuttlefish, cut cuttlefish pinecone, frozen comb cuttlefish, processed cuttlefish, squid sushi, breaded octopus ...

Together with VJFTA, the CPTPP Agreement, which came into effect in early 2019, partly helps facilitate the export of Vietnamese squid and octopus to Japan.

According to ITC, in 2019, Japan's squid and octopus imports reached over 406 million USD, up 13.9% compared to 2018. In particular, cuttlefish and squid processing items were imported the most, accounting for 77% import value.

Processed squid (HS code 160554) is the most imported product into Japan in the country's total structure of imported squid and octopus products, accounting for 70% of the proportion. In 2019, Japan increased imports of processed squid and reduced imports of processed octopus. Notably, Japan sharply increased imports of fresh / raw squid (HS code 030749) in 2019, an increase of 1,736% compared to 2018 reaching USD 45.3 million.

Regarding the main import item of Japan which is processed squid, Vietnam is in the top 4 largest suppliers, after China, Peru and Thailand and above Korea and Spain. China dominates the market share in this product group with 88% of Japanese import value, while Vietnam accounts for less than 2%.

Source: http://vasep.com.vn/

Related Post

The true fishmeal carbon footprint

The established Life Cycle Analysis (LCA) methodology to assess the fishmeal carbon footprint only accounts for the vessel fuel and post-harvest processing energy while ignoring the carbon sequestration potential of fish.

View more

Freezing Tropical Fruits: Convenient and Effective Solution with Octofrost Machines

Tropical fruits are always a great choice for providing nutrition and fresh flavor to daily meals.

View more